Gaming Has Become a Premium Media Environment

By 2024, more than 3.4 billion people worldwide were playing video games, accounting for over half of the online population, according to the Harvard Business Review. That growth has continued, making gaming one of the most valuable attention environments for digital media.

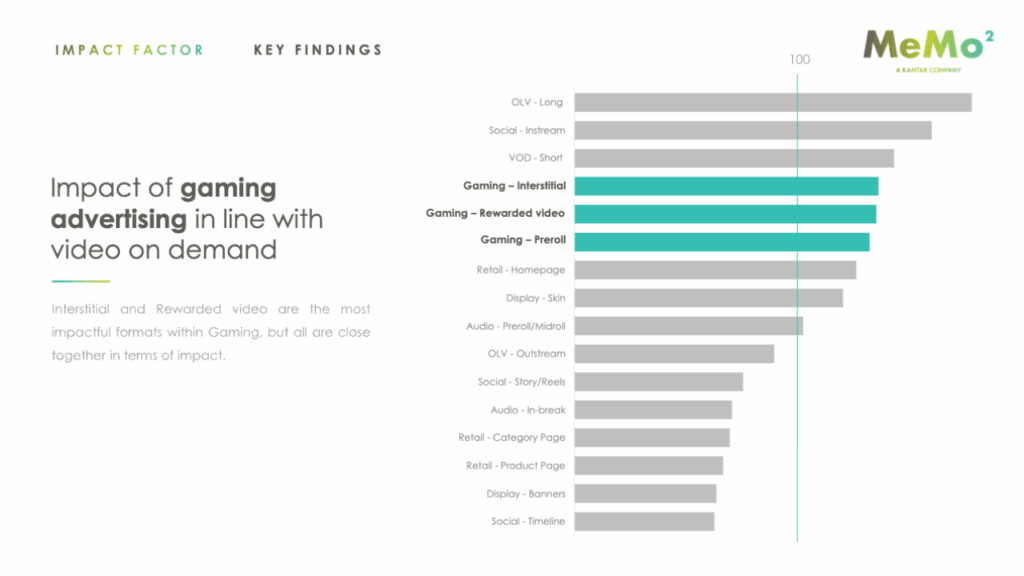

A study by GroupM Netherlands and Memo2, in collaboration with Azerion, Amazon (Twitch), and Digital Turbine, compared the performance of gaming ads with that of other major digital channels. The study measured formats such as preroll, rewarded video, and interstitial ads, and benchmarked them against short-form video on demand.

The findings revealed that gaming advertising delivers brand impact on par with premium video channels in terms of ad formats. Rewarded video and interstitial ads were especially strong, performing close to or even matching the effectiveness of widely used VOD placements.

The key takeaway is simple: working with GameDistribution means publishers can access games that already carry ad experiences proven to meet the standards of premium video inventory.

Rewarded Ads Turn Engagement into Longer Play Sessions

The strongest performer in the study was rewarded videos, especially when paired with a short interactive end card. This combination delivered 14 percent higher brand impact for advertisers compared to video alone, while also ranking lowest for disruption.

What makes rewarded ads powerful is how they are perceived. Because they feel like part of the game rather than an interruption, players stay immersed, return more often, and interact more deeply with the site.

To ensure this balance, GameDistribution works with developers before launch to test rewarded video placements. Developers are guided to integrate rewards in ways that enhance play, such as unlocking extra spins or lives, reviving after a loss, or offering a daily gift that doubles rewards. These mechanics turn ads into moments players welcome rather than avoid.

The outcome is a game catalog that maximizes both advertising impact and player satisfaction. As advertisers continue to see stronger brand lift from these formats, their investment in gaming grows, which translates into better monetization opportunities for publishers and developers.

Mid-Roll Ads Create Awareness but Need Careful Balance

Mid-roll ads, often called interstitial ads, also performed strongly on brand awareness for advertisers. Because they appear during gameplay, they deliver strong visibility. Yet if placed too often or at the wrong moment, they risk breaking the flow of play.

To avoid that, GameDistribution ensures ads appear only at natural break points, such as after a level ends, and limits how often they are shown in a session. Creative rotation prevents players from seeing the same ad repeatedly, while quality checks on gameplay loops, visuals, and balance ensure players remain engaged long enough to reach those triggers.

For publishers, this means every title distributed through GameDistribution has already been tested to strike the right balance between ad timing and player experience. The ads drive monetization while keeping players engaged longer on the site, turning attention into sustainable revenue without having ad fatigue.

Player Involvement Matters More Than Screen Size

One of the most important insights from the ContextLab study is that player involvement is a stronger driver of ad effectiveness than screen size. Whether someone plays on a desktop or mobile, immersion matters more than resolution or device type.

The data reinforces this point: 71 percent of online game players prefer mobile, and 60 percent play daily. That frequency compounds opportunities for exposure, building loyalty, and strengthening monetization with every session.

Industry Research Confirms the Trend

The ContextLab findings align with broader industry signals about gaming advertising. Think with Google shows that Gen Z players are especially receptive to rewarded ads when they feel purposeful and tied to value. This means these formats are not only accepted but actively welcomed by younger audiences, helping to sustain engagement.

The IAB’s 2024 Creative Guidelines reinforce the same point. They recommend short, clear, and device-consistent formats that respect the flow of gameplay. These best practices mirror how GameDistribution prepares its catalogue, ensuring ads deliver results for advertisers while remaining enjoyable for players.

Harvard Business Review adds another perspective: games are no longer niche entertainment but a mainstream relationship channel. Casual titles now strengthen digital publishing in tangible ways. Many news outlets use bundled game experiences to extend time on site and support subscription growth, proving the role of games in building recurring audience habits.

Games have also become part of popular culture by drawing inspiration from films, series, and shared entertainment experiences. Players connect with these formats because they feel familiar, easy to pick up, and rooted in stories they already know.

Together, these shifts highlight why gaming advertising has become both a cultural touchpoint and a practical driver of digital growth. Integrating games through GameDistribution means delivering content that fits seamlessly into modern habits while strengthening engagement and retention.

The Advantage of Partnering with GameDistribution

Publishers do not need to worry about SDK integrations, frequency capping, or creative setup. GameDistribution handles all of this directly with developers before titles go live. What publishers receive is the result:

- Games with ad experiences optimized for engagement and retention

- Player journeys are designed to encourage longer sessions and repeat visits

- Monetization powered by formats proven to perform at the level of premium video

In practice, partnering with GameDistribution gives platforms immediate access to games designed to satisfy both players and advertisers. All technical and ad-related complexities are handled behind the scenes, allowing publishers to concentrate on growing their audiences and securing long-term revenue.